The coronavirus pandemic is hitting private equity firms particularly hard. But with certain sectors in telecommunications, media and technology poised to grow due to pandemic dynamics, the industry is attracting attention.

Private equity often relies on leverage, both new issuance and refinancing, as part of its investment model, but banks have largely restricted access to credit markets due to uncertainty surrounding the coronavirus. With markets tight and investors hungrily looking for a return, they see possibilities within the TMT industry as Americans work, shop and learn from home.

Recessions can represent incredible opportunities for outperformance in the right sectors, and growth investors “want to be on the right side of history,” Bain & Co. partner David Lipman said in an interview.

Some segments, like enterprise software and video conferencing products, are showing marked increases amid the pandemic and still attracting investment.

“It’s harder to get deals done right now, but it’s not impossible,” Lipman said.

Information technology has maintained relatively strong trends. According to an S&P Global Market Intelligence analysis of M&A deals and private placements involving U.S. targets, and buyers who were either private equity or venture capital firms, the sector saw 440 deals in the first quarter of 2020. The next two largest sectors by deal volume, healthcare and industrials, saw just 212 and 134 deals, respectively.

The analysis does not include terminated deals or deals involving only assets or brands.

Insight Venture Management LLC, also known as Insight Partners, in April announced a $9.5 billion fund focusing on enterprise software companies. Other tech-focused firms — such as Silver Lake Management LLC, which in early May put about $746 million in Indian tech company Jio Platforms Ltd.; and Francisco Partners Management LP, which in April said it will raise about $7.95 billion across two funds — are sitting on billions in client money they still must put to work, 451 Research analyst Brenon Daly said in an interview.

“They can’t just put a closed sign on the door,” Daly said. “They have to be transacting.”

Indeed, many private equity funds are sitting on historic cash reserves, and some deals are being done with that equity, rather than debt, with the intention to refinance once markets loosen up. Additionally, some will likely return to the table after taking the pandemic as a diligence period, ready to sign deals as soon as capital is available and valuations are reasonable.

“There is a disconnect between the unusually strong stock market recovery, and the underlying economy, creating a rift between public and private market valuations,” Ben Axler, founder of an investment manager and activist short-seller Spruce Point Capital Management LLC, said in an interview, noting that some public deals involving “rich valuations” have already fallen apart.

Spruce Point played a key role in the collapse of Advent International Corp.’s planned $1.9 billion acquisition of cybersecurity company Forescout Technologies Inc., having sent the private equity fund a letter urging it to reevaluate or abandon the deal.

With stock markets at generous highs while earnings have sunk to relative lows, there is an increasing disparity between the market value of a company and what a private investor is willing to pay for it, Lipman agreed. This is temporarily keeping some PE firms on the sidelines.

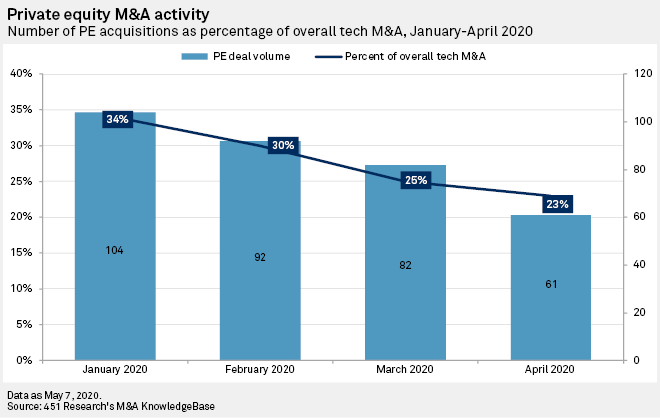

While deals in the TMT space are up versus other sectors, technology and telecom private equity transactions dropped 40% in April compared to January, and May is on a similar track as April, according to 451 Research. Private equity has also dropped its share of participation in the tech M&A market after hitting record highs in 2019. Private equity’s share of overall tech M&A volume dropped to 23% in April from 34% in January.

Lipman, though, believes April and May could represent the low point for private equity.

According to his firm’s research, deal activity in the technology and software sectors bottomed out about two quarters following the Lehman Bros. collapse that sparked the 2008 Great Recession. Subsequently, those two sectors rebounded faster than others.

In the meantime, many firms are focused on supporting their portfolio companies, keeping liquidity flowing to existing investments hardest hit by the coronavirus pandemic. Where M&A is taking place, it tends to be focused on strategic add-ons to portfolio companies rather than entry into new markets, according to 451 Research.

“The first four weeks of lockdown were triage,” one TMT-focused private equity executive said in an interview. Now firms are “trying to get a grasp of what life is going to be like not just for the next three to six months, but for the next 12, 18 and 24 months. … Deal volume is down because everyone is spending a lot of time with their portfolios.”

While many portfolio companies may disappear during the pandemic downturn, particularly those that were focused on growth prior to the pandemic period even at the cost of profits, others are growing rapidly, the executive said. Whereas in the 2008 recession, private equity was “demonized,” in this downturn “they’re there to invest … to promote growth and rehabilitation in many cases, and they’re going to play a key role in stabilizing the economy.”

451 Research is an offering of S&P Global Market Intelligence.

Credits to www.spglobal.com newsroom